Subscriptions sneak up on all of us.

Streaming services, fitness apps, productivity tools, AI tools, there are now more of them than ever, and it seems that everything now charges a subscription fee or has a subscription model.

All those free trials that charge you without realising, or those small monthly charges can add up to serious money and mental clutter.

Every sub is on a different billing cycle, charge happen at different days of the month, some on apple, some through regular bank cards, it becomes almost impossible to keep on top of them without discipline or tools.

That is why subscription tracker apps that help you to get on top of your recurring expenses are becoming very popular in 2026.

In this guide, we compare the best subscription tracker apps in 2026 based on our own research and experience of features, ease of use, platforms, and who each app is best suited for.

Whether you want full automation, simple manual tracking or full customisability with added budgeting features, there is an option here for you.

Introduction: What are Subscription trackers and why are they useful?

Subscription tracking apps help you stay in control and see where your money is going, spot forgotten renewals, alert you before free-trials end, and avoid paying for services you no longer use.

Some apps go further by negotiating bills on your behalf, canceling subscriptions for you, or tying everything into a full budgeting system.

The best subscription tracker app is not the same for everyone. Some people want hands-off automation, while others prefer privacy and manual control. This also varies by market and some users are also more cost conscious than others when it comes to what tool they use. Let’s break down what to look for before choosing.

Types of Subscription Tracking Apps

Not all subscription tracking apps are designed the same, they cater to a wide range of budgets, geographies and personal tastes. Some users are more privacy conscious or want more hands on control.

Here are the different types of subscription Trackers:

Manual:

These apps are essentially a glorified spreadsheet in app form with a few extra features. They give users a clean interface to manually add each subscription and keep track of them. Some even have features for setting push notifications. They are good for those who like to do it manually or are extra privacy conscious, but they take more time and upkeep and makes it easy to miss subscriptions.

Email parsing or spreadsheet import:

These apps include features above manual apps, where users can either upload existing spreadsheets (This is often how many people start tracking) that pick-up their subscriptions, or allow them to connect read-only access to their emails which detects their subscriptions that way and loads them in.This can pick up a good number of subscriptions, but also misses those that don’t send email confirmations.

Automatic and bank-connect:

These apps include a feature to connect cards and banks with read-only permissions for subscriptions through bank aggregators such as Plaid and others. These can automatically scan and pick up hidden subscriptions. They can sometimes have inconsistencies with the data and are often limited when it comes to geographies or eligible connected banks.

Read about bank-connect subscription apps.

Quick Feature Comparisons of Top Subscription Trackers

App | Best For | Tracker Type | Cancel Support | Virtual Cards | Price | Platforms |

|---|---|---|---|---|---|---|

Rocket Money | U.S users wanting automation and budgeting but without a super complex interface. | Auto via bank sync | Concierge (Premium) | Yes Visa Signature through Rocket Card but seems on pause. | Freemium & $6–12/month | iOS, Android, Web (limited) |

Hiatus | US users who want Simple UI + basic bill negotiation and suggesting cheaper alternatives. | Auto + manual | Concierge (Premium) | ❌ | Free (limited) & $9.99/month | iOS, Android, Web (basic) |

Trim | US users who want free basic automation and subscription management. | Auto + concierge | Concierge (Premium) | ❌ | Free & Advanced features only available to Onemain users | Web only |

Emma App | UK/EU users who like a beautiful app interface and want automated budgeting, subscription tracking and tips. | Auto via Open Banking | ❌ | ❌ | Free (limited) & multiple tiers up to £14.99/month | iOS, Android |

Bobby/Subby | Global manual-only users (iOS/Android) cheap lifetime access | Manual only | ❌ | ❌ | Free for limited number of subs (5) then ~$3–5 (one-time) | iOS (Bobby), Android (Subby) |

TrackMySubs | Global freelancers/small teams tracking SaaS manually who want more visibility, | Manual only | ❌ | ❌ | Free for limited numbers of sub then – $10-30/month | Web only |

YNAB | Budget-first users who want deep financial control beyond just subscriptions. | Manual / optional sync | ❌ | ❌ | $14.99/month or $99 a year | iOS, Android, Web, Desktop apps |

Orbit Money (Beta) | Global users and creators wanting subscription clarity & control + automations. | Auto, email, upload + manual (planned) | Yes (planned) | Virtual cards planned for general spending, easier cancellation and free trial cards. | Free (waitlist and initial phase) Future: Freemium with premium tiers offered. | iOS, Android, Web (planned) |

What to Look for in a Subscription Tracker App

Before downloading an app, look for these key factors when considering which app to use:

Automation level

This is usually both preference and geography dependent. Check if you’re eligible based on your bank and country, many of the ones listed are US based.

Also your preference if you feel comfortable connecting to an aggregator such as plaid or you prefer to take an alternative route.

It’s also important to look at reviews and understand that some of the apps do a better job at classification than others.Free vs paid and limits

This is really important to refer to as there’s a wide range on which apps are free vs limited on their free plans or those that gate features behind a subscription paywall. Make sure to pick the app that fits your demand and budget.

Are you using it for personal or for business/SAAS?

The majority of these listed applications are more tailored to individual needs rather than business/entrepreneurs who might need separate categorisation between personal and business or additional features. Make sure to check based on your needs.

Notifications/Alerts

Look for desired methods of alerts so you can ensure you cancel those free trials on time and you are reminded of renewals even when not checking the app.

Apps that have widgets can also be a bonus.Cancellation support

See if this feature is important to you in your desired app. Some apps help you to automatically cancel subscriptions, but they can’t cancel with all providers and sometimes ask for extra details.

Others just guide you through how to cancel.Budgeting features

Some apps are purely focused on subscription management, whereas others have budgeting features and focus, here it will depend on whether you want a border financial management app vs simply gaining control on your subscriptions.

Platforms supported

This depends on your device and the way you prefer to manage your subs, whether just a web app is ok or whether you’re more likely to do it on your mobile.

Privacy and security

This is very important to look into for any app you choose especially if it involves bank connections, the apps never have access to your logins and your are dealing with trusted intermediaries but it’s important to note what these companies are doing with your data. Both in how safe they store it but also whether they sell it or use it to sell external services to you. For example rocket money is part of rocket companies that may use data to check for mortgage eligibily and other things.

Learn more about essential features to look for when choosing a Subscription Tracker App

Best Subscription Tracker Apps 2026

Based on our own research and experience we have curated a list of the top subscription tracking apps in 2026.

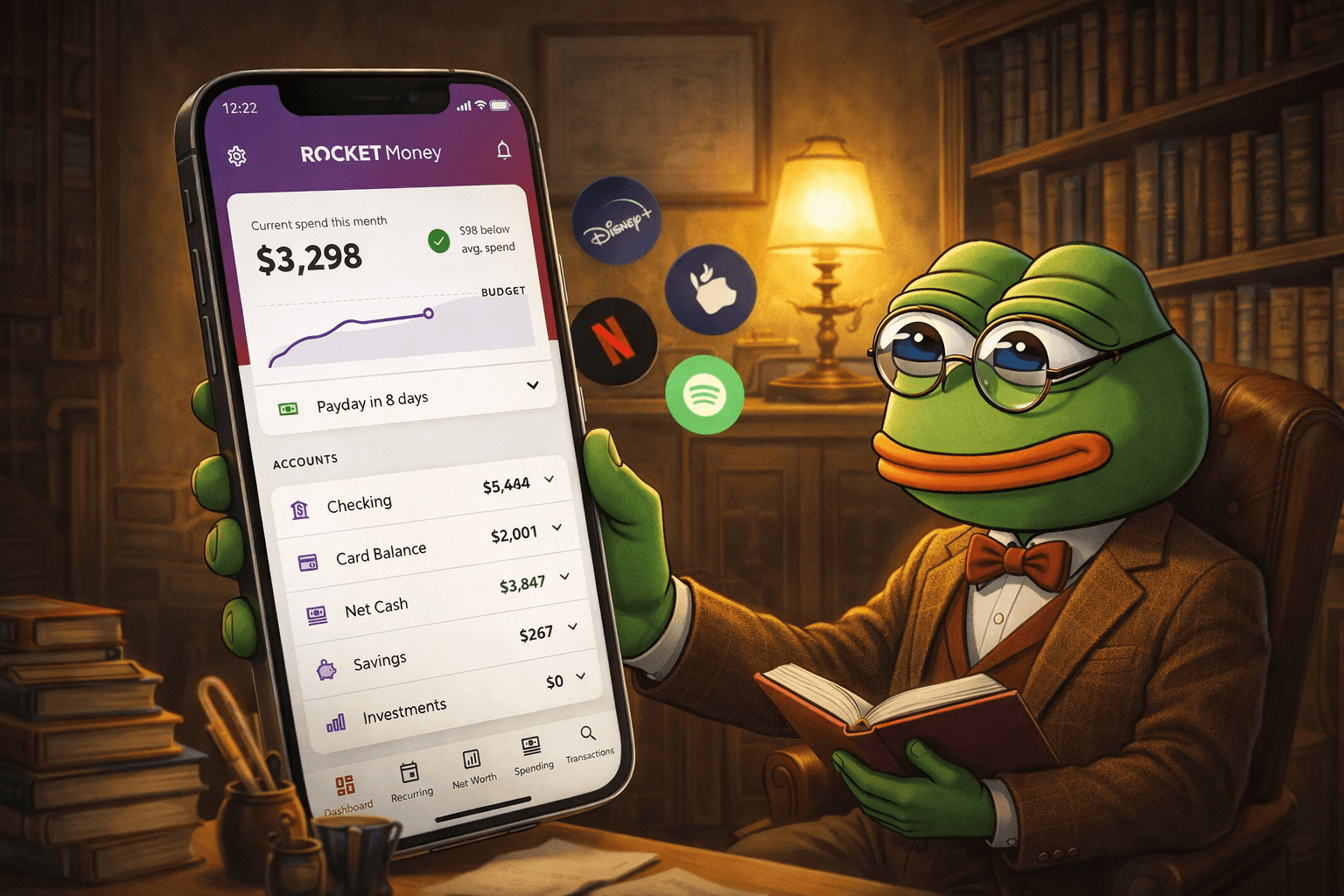

Rocket Money (previously Truebill)

Website:

Best for:

People in the U.S. who want a hands-off way to manage subscriptions, lower bills, and see spending insights via bank connection primarily.

Cancelling subscriptions through their concierge service was one of their flagship core features.

They have the highest reputation and multiple useful features.

Type of Tracker:

Automated: Connects to your bank and credit card accounts to track recurring charges and identify subscriptions.

Platforms: iOS, Android and Web (limited functionality)

Markets Served:

United States only (No support for international banks or currencies)

Pricing:

Free and premium

Free Version Includes | Premium Version |

|---|---|

Subscription detection & cancellation suggestions

| $6–12/month (user decides how much to pay)

|

Rocket money’s business model also likely relies on data capture for their other services such as rocket mortgages.

Key Features of Rocket Money:

Subscription: Detection and cancellation with bank account sync

Bill Negotiation: concierge will attempt to lower bills like phone, cable (Premium, success fee applies)

Smart Savings: helps move small amounts of money into savings automatically (Banking partner)

Spending Insights, goals & Budgets

Credit Score Monitoring

Pros:

Cons:

Fully automated, minimal manual input

Really simple and clean UX

Helpful savings and bill-lowering features

Transparent alerting for changes in subscriptions or charges

Biggest in the market and strong reputation. Owned by Rocket Companies (well-funded and stable)

U.S only (no international support)

Subscription cancellation sometimes takes weeks and doesn’t always work.

Users have reported bank sync issues and data not showing accurately

Cannot pause subscriptions, only cancel

What Users Are Saying:

Reddit (r/personalfinance, r/frugal, r/fintech):

Mixed reviews on cancellation concierge effectiveness, some say it works well, others claim support is slow. Doesn’t cover all services.

Some concerns about privacy when connecting banks, but no major security issues reported. Issues with certain banks and picking up certain subscriptions accurately.

Widely appreciated for surfacing “forgotten” subs and pushing alerts.

Users complain that it doesn't work with a lot of their banks.

App Store Reviews:

Generally positive (4.7+ rating)

Why we included it/Our Summary:

Even though it only serves the US market, Rocket Money is one of the most popular and user-friendly subscription trackers that filled a big hole when Mint closed down.

It has great UX and is great for beginners with the basic features remaining free.

Its features suit more everyday users than power-users or business-heavy users.

That said, it’s only available in the US, (if international consider these other other alternatives) and many of the features that sound automatic (like cancellations) still take time and manual follow-up. The Premium tier unlocks most of the powerful functionality, and the success fee on bill negotiation is great but eats into the amount saved.

→ Read the full Rocket Money Review

Hiatus

Website:

Best for:

U.S users who want a simple, mobile-first app to track subscriptions, cancel unused services, and negotiate bills, without dealing with full budgeting dashboards or complex financial tools.

Hiatus is ideal for people who just want to manage subscriptions and are overwhelmed by the features of the apps like Rocket Money and just want to cut waste, spot price hikes, and get hands-off help with recurring expenses like rent, phone, or internet, all with simple UX.

Type of Tracker:

Automatic: connects to your bank accounts and cards to detect and track recurring payments, subscriptions, and bills.

Can also add subscriptions manually.

Platforms:

iOS, Android, Web app (basic)

Markets Served:

United States only (Requires a US based bank or card connection)

Pricing:

Hiatus offers a freemium model:

Free Version Includes | Premium Version |

|---|---|

Track spending and transactions Detect recurring subscriptions Set up alerts Credit score monitoring | $9.99/month or $59.99/year Cancel subscriptions via in-app concierge Bill negotiation (e.g. phone, internet, utilities) (success fees charged) Smart financial insights + personalized suggestions Autopilot tools like subscription cancel |

Key Features:

Subscription Detection: auto-tracks recurring expenses with bank connect

Bill Negotiation and subscription cancel: helps lower cable, phone, insurance bills + concierge-style cancellation

Spending Insights & Budget Tracking

Smart Suggestions: e.g. flagging unused services or suggesting cheaper insurance

Upcoming Bill Alerts

Pros: | Cons: |

|---|---|

Clean, polished interface with a simple mobile-first experience. Less clutter than more complex apps. Easy to understand insights on bills and subs Helpful auto-alerts for subscription price hikes or new charges “Autopilot” feature offers suggestions for savings you can accept or decline | U.S. only Concierge cancellation can take days to weeks Some users report double charges or failed cancellations Not many power-user or advanced budgeting tools |

What Users Are Saying:

Reddit (r/fintech, r/personalfinance):

Some find the cancellation features helpful, especially for gym memberships or phone plans.

Users note issues with delayed cancellations or lack of updates on negotiation attempts. (Poor support)

A few complaints about the high premium fee vs. value provided.

App Store:

4.6+ stars on iOS

Our Summary:

Hiatus is a solid alternative for users who want to access subscription management without too many extra features and who care about a slick mobile experience. There’s a lot of automated alerts which can be helpful when saving money.

Although again, like Rocket Money, it’s U.S-only, requires bank access, and places key features behind a $10/month paywall. The concierge-style experience is convenient, but not always fast, and users looking for full control or international support may find it lacking.

→ Read our full Hiatus App review article

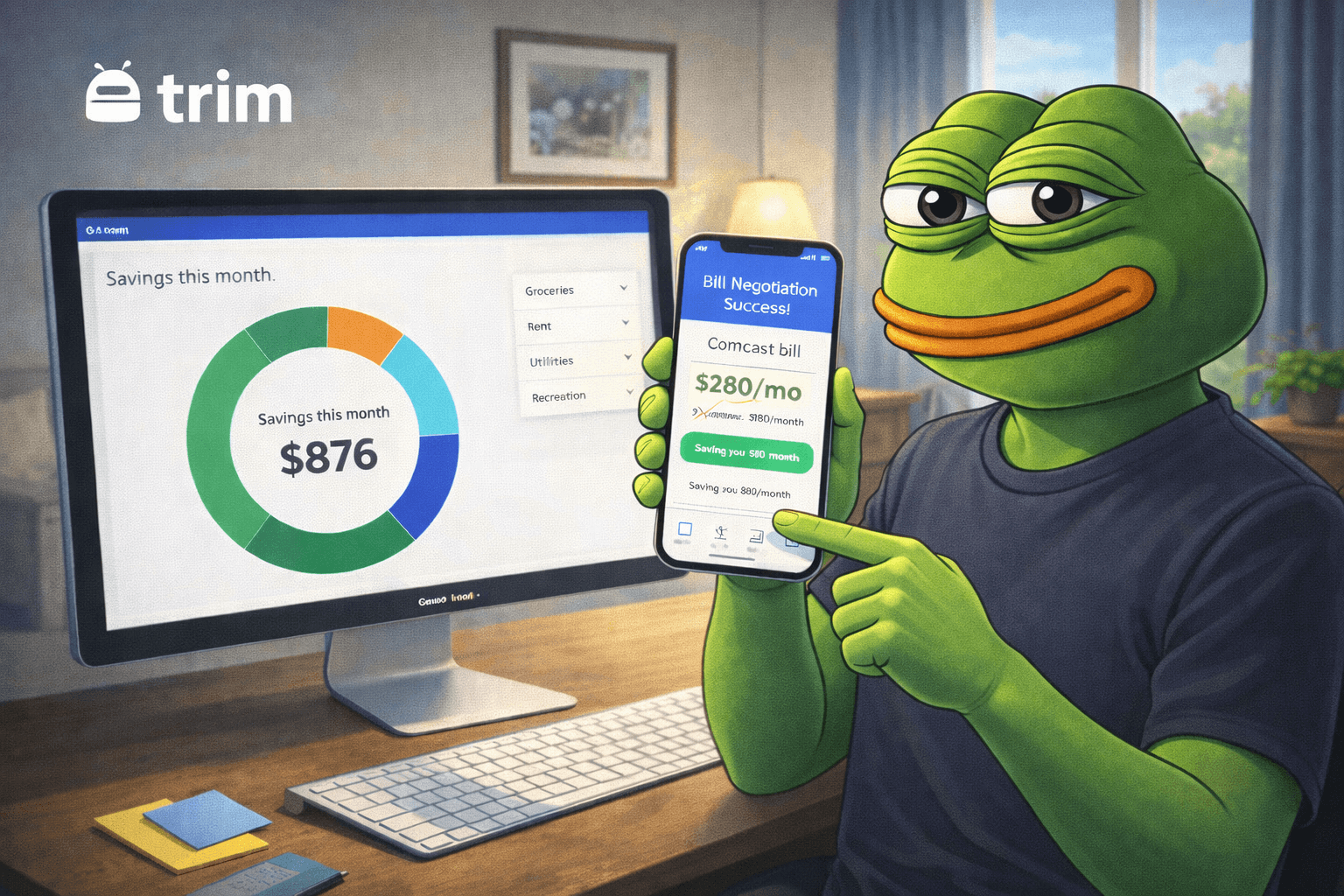

Trim (also known as AskTrim by OneMain)

Website:

Best for:

U.S. users who want to negotiate bills and cancel subscriptions easily, without navigating bloated apps or mobile dashboards. Unlike other tools that emphasize budgeting or visual spend tracking, Trim focuses much more on the saving money aspect making it a strong choice for users who care more about results than real-time tracking or design polish.

“Help me save money in the background, I don’t want to look at charts.”

Type of Tracker:

Automatic + Concierge hybrid:

Connects to your bank account to detect recurring charges, then offers bill negotiation and subscription cancellation handled by the Trim team.

Platforms:

Web app only (no native iOS or Android app)

Mobile access available via browser, but not optimized for mobile

Markets Served:

U.S. only - Requires a U.S. bank or credit card connection

Pricing:

Free Version Includes | Premium Version |

|---|---|

Automatic subscription detection Bank account syncing Spending analysis and insights Bill reminders and alerts | Trim Premium - free but only available to clearway or OneMain users Bill/Medical bill negotiation (Pay % of saving) Bank fee refunds Premium support |

Key Features:

Automatic subscription detection via Plaid

Bill negotiation (phone, internet, cable, medical) + subscription cancellation concierge

Bank fee refund requests

Spending categorization and analysis

Bill reminders and overdraft alerts

Pros: | Cons: |

|---|---|

One of the original tools in the space (launched in 2015) Simple, no-frills experience that focuses on saving money Powerful negotiation features that handle providers directly Free tier offers good visibility over recurring charges | No mobile app: browser-only experience Key features locked behind $99/year Premium U.S only Bill negotiation and cancellations can take time Less transparency or user control compared to newer tools Minimal updates and slower support in recent years |

What Users Are Saying:

Reddit:

Users report success negotiating Comcast and Verizon bills

Mixed feedback on support speed and cancellation success

Users complain about no app

A lot of security complaints of data breaches from years back

Our Summary:

Trim is a little bit outdated compared to some of its counterparts, although it still has powerful features for saving more on your subscriptions and bills. Especially if you want a super basic set-and-forget tool.

However, the lack of a mobile app, reliance on paid tiers, potential security concerns, and slower feature development may be dealbreakers for more engaged users.

Emma App

Website:

Best for:

UK and EU users who want an all-in-one finance app that blends budgeting and subscription tracking, with smart alerts and deep control over spending.

Emma is ideal for people who want to see everything in one place (bank accounts, subscriptions, investments), enjoy a beautiful intuitive UX, and don’t mind paying to unlock more features.

It also has a paid tier for business-focused users.

Not great if you want features to cancel subscriptions directly or avoid constant upsell ads.

Type of Tracker:

Automatic tracking via Open Banking (UK/EU) and Plaid/Yodlee (US)

Pulls subscription data from connected accounts

Also includes aggregating crypto tracking, stock tracking, and more

Platforms:

iOS, Android, and Web (limited to basic account access)

Markets Served:

🇬🇧 United Kingdom (main market)

🇪🇺 European Union

🇺🇸 United States (limited support, fewer integrations)

Pricing Tiers:

Free Version Includes |

|---|

Connect 2 bank accounts Budgeting and subscription detection Basic categorization Manual tagging |

Emma Plus – £4.99/mo |

|---|

Fraud detection Offline accounts Custom categories |

Emma Pro – £9.99/mo |

|---|

Split payments/bills between friends Export data Reorder/rename categories Budgeting rules |

Emma Ultimate – £14.99/mo |

|---|

Networth tracking Cashback (UK-only) Business accounts |

Note: Many users report frequent upsells and paywalls, even after subscribing.

Key Features:

Automatic subscription detection from bank transactions

Weekly/monthly budgeting by category

Investment and crypto tracking (optional)

Real-time alerts for spending, bills, and subscription changes

Cashback rewards (UK only)

Net worth tracking (paid tiers)

P2P payments and split bills

Rent reporting to boost credit score

Pros: | Cons: |

|---|---|

Strong support for UK and EU banks Flexible budgeting system with deep customization Great for managing subscriptions alongside broader finances Very strong feature set that includes: Crypto tracking, stocks, gifting, bill splitting and even employee perks | No subscription cancellation feature, tracking only Most features sit behind multiple paid tiers with constant upsells and in-app prompts can frustrate users Weaker support and integrations for U.S. customers Some niche features (e.g. fractional investing) feel underbaked |

What Users Are Saying:

Reddit & Finance Blogs:

Praised for sleek UI and multi-account visibility

Criticized for locking too many features behind upgrades and really annoying constant upsells and ads

Subscription detection accuracy can be hit or miss

U.S. users note slow support and lack of key bank integrations

App Store: ⭐️ 4.7

Our Summary:

Emma is very underrated as a feature-rich money app that has decent presence in the UK and EU. It’s great for users who love a great UX and enjoy board features inside a single app.

However, it's missing some of the cancellation and automation features of the other applications, but has its own broad set of features to make up for it. One common complaint is being too aggressive with their upsells and monetisation & alerts which gets in the way of the smooth UX.

It also has options for business users which are key to a large segment of heavy subscription users.

→ Read our full Emma App review article as well as contraversies

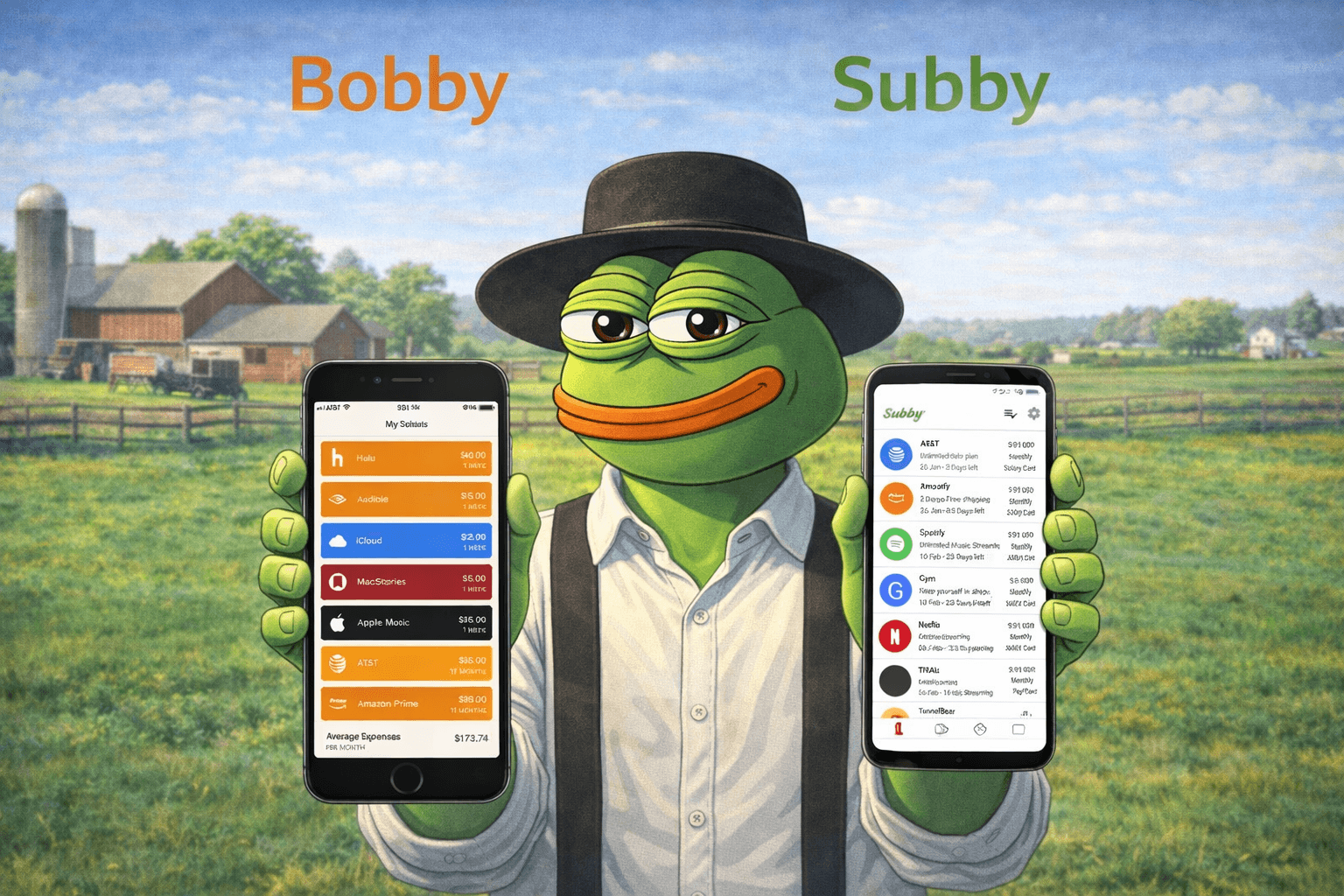

Bobby & Subby

Two minimalist, manual-only subscription tracking apps, one for iOS, one for Android.

Websites:

Bobby (iOS): https://bobbyapp.co

Subby (Android): https://subby.online/

Best for:

People who want a simple, one-time purchase tool to keep track of their subscriptions without connecting a bank account or sharing sensitive data.

Bobby is best for iPhone users who prefer elegant design and minimal distractions.

Subby is better for Android users who want a lightweight, functional option with reminders and tagging.

These apps are great for users who value privacy, want full control, and don’t mind entering data manually. Basically the next level up from a spreadsheet.

Type of Tracker:

Manual entry only: No automation, no bank syncing.

You manually enter subscription details (price, billing date, frequency, etc.) and get alerts based on your setup.

Platforms:

Bobby: iOS only

Subby: Android only

Markets Served:

Global: no country restrictions, since they don’t rely on open banking or local integrations.

Pricing:

Bobby (iOS) | Subby (Android) |

|---|---|

Free: Limited number of subscriptions Paid: ~$3.99–4.99 (one-time payment for unlimited subs) | Free: Track up to 5 subscriptions Premium: ~$2.49–3.99 (one-time unlock for full access) |

Key Features:

Bobby (iOS) | Subby (Android) |

|---|---|

Clean, minimalist interface Custom billing intervals and currency support No account or login required (data stored locally) One-time purchase model (no recurring charges) | Manual entry with color tags and categories Custom billing frequency + multi-currency support Push notifications for payment reminders Lightweight and functional UI |

Bobby Pros | Bobby Cons |

|---|---|

Simple UI and very intuitive One-time cost, no subscriptions or in-app ads Perfect for low-maintenance iOS users | No Android or desktop version No automation = more effort to maintain Lacks analytics or long-term spend insights |

Subby Pros | Subby Cons |

|---|---|

Budget-friendly and efficient Push reminders for due dates Doesn’t require signup or personal info | Android-only and not actively updated Design and UI are more basic No data syncing or backup |

What Users Are Saying:

Bobby:

⭐ 4.5+ rating on the App Store

Praised for simplicity and design

Some users wish it included export or sync features

Subby:

⭐ 4.3+ rating on Google Play

Liked for its lightweight setup and notifications

Some complaints about bugs or lack of updates

Our Summary:

These tools are simple and great if you want the next step up from no tracking or manual spreadsheet tracking.

They are low cost and straightforward platforms that just work.

Neither offers automation or advanced features, but that may be exactly what privacy-focused, minimalist users are looking for.

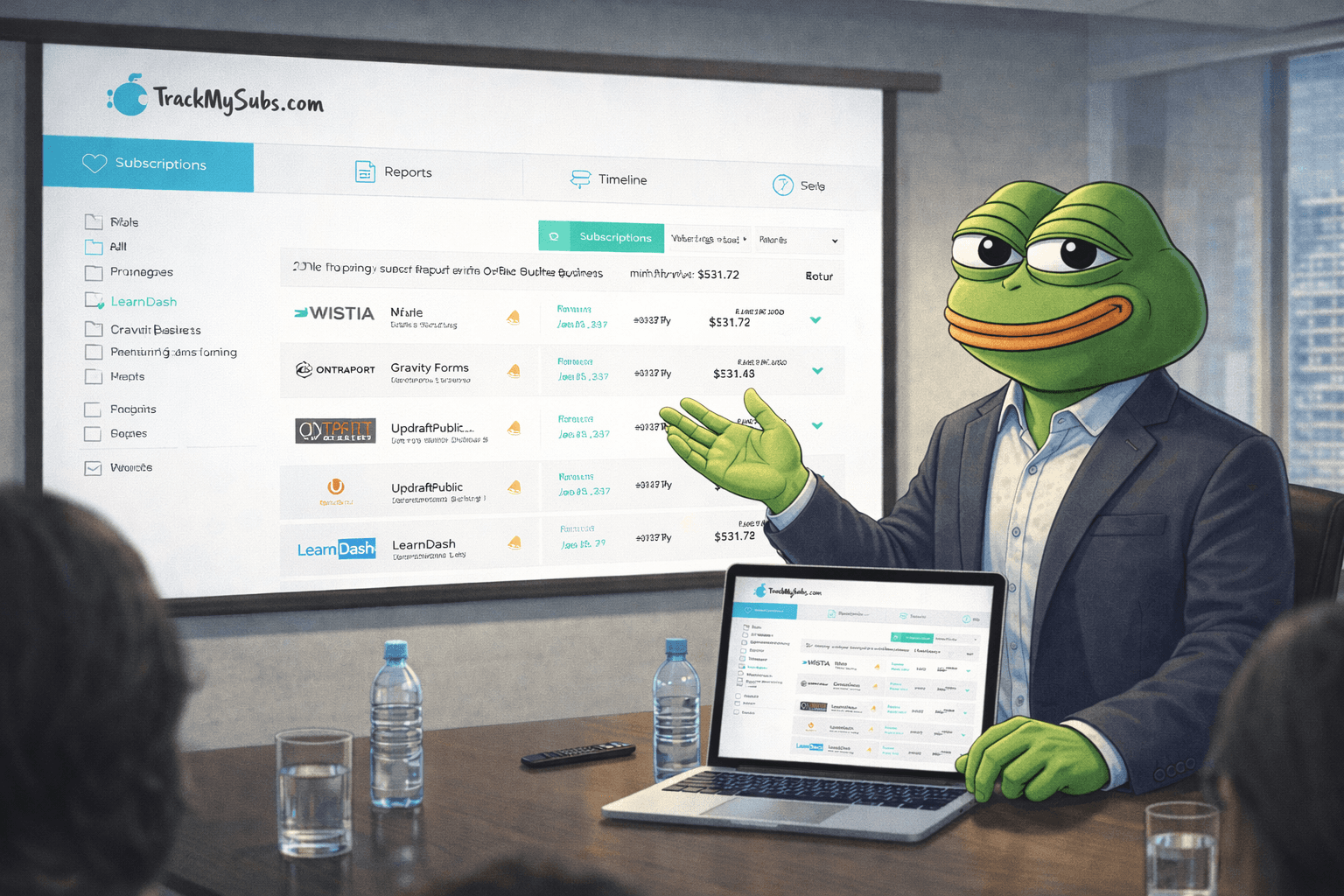

TrackMySubs

Website:

Best for:

Freelancers, consultants, and small business owners who need a manual-first, privacy-focused tool to organize and stay on top of dozens of recurring subscriptions, especially SaaS and professional tools.

TrackMySubs is more business oriented than the other listed tools and is ideal if you don’t want to link a bank account but still want clear renewal visibility, team access, and structured reminders in a web-based dashboard.

Type of Tracker:

Manual subscription tracker, no bank sync.

All entries must be added by the user, but can be imported via spreadsheet or CSV.

Platforms:

Web only (no mobile app)

Mobile-accessible via browser, but not optimized

Markets Served:

Global: no geographic restrictions since it doesn’t rely on bank integrations.

Pricing:

Free Plan |

|---|

Track up to 10 subscriptions |

Unlimited: $10/month |

|---|

Unlimited Subs, alerts, tags and folders. |

Enterprise: $30/month |

|---|

Unlimited subs + multi-user business accounts |

Key Features:

Custom email reminders for renewals and payments

Tagging and categorization (e.g., work vs personal)

Multi-user support for teams (Enterprise plan)

Upload via CSV/spreadsheet

Pros: | Cons: |

|---|---|

Great for solopreneurs or teams managing SaaS tools Easy to scale up with team or business usage More structured than mobile-first manual apps like Bobby or Subby | Manual input required for all data No mobile app, only accessible via browser Outdated UI and slower product development in recent years Limited integrations, doesn’t connect to accounting or finance tools Limited free tier |

What Users Are Saying:

“Great for managing SaaS tools for my business.”, Users like the structured, no-nonsense setup and alerts.

“Wish there was a mobile app or auto-sync option.”

Reviews are mostly from 2019–2021, with limited recent updates. Users still say the tool works reliably but want to see more innovation.

Our Summary:

TrackMySubs is an Australian founded platform which has tiers in more global markets. It’s a niche but valuable tool mainly suitable for founders, small teams and solopreneurs managing lots of paid tools, SAAS, or recurring business services. It’s not a consumer-first app and doesn’t try to be.

It has features for teams and is best for those who don’t need a mobile app or automation, and prefer spreadsheet-like control over SaaS spend. But if you’re a personal finance user looking for bank integrations or app-style UX, this won’t be the right fit.

YNAB (You Need A Budget)

Website:

Best for:

People who want total control over their finances and are fully committed to a manual, rule-based budgeting system.

YNAB is not a dedicated subscription tracker, it’s best for those who want to assign every dollar a job, plan ahead, and don’t mind manually organizing subscriptions inside a broader financial workflow.

Type of Tracker:

Manual-first budgeting system with optional bank syncing.

Subscriptions can be tracked using custom categories and scheduled transactions.

Platforms:

iOS and Android apps

Web including macOS and Windows apps

Markets Served:

Global (Syncing with banks works best in the U.S; international support can be hit or miss)

Pricing:

Free Trial | 34 days |

|---|---|

Paid | $14.99/month or $99/year |

Students | Free for 12 months |

Key Features:

Zero-based budgeting give every dollar a job

Manual or automatic import of transactions

Goal tracking and progress planning

Subscription management through custom categories or future-dated entries

Reports & insights on categories, trends, and income vs expenses

Pros: | Cons: |

|---|---|

Best-in-class for detailed, intentional budgeting Highly customizable: tailor it to your personal system Can manually track subscriptions and create dedicated workflows Great for long-term financial behavior change | Not designed as a simple subscription tracker: no simple flow, no reminders Steep learning curve for new users, pretty advanced. Requires time and commitment to use effectively Premium cost is high if you only need it for subscriptions |

What Users Are Saying:

Reddit (r/YNAB, r/personalfinance):

“Create a Subscriptions category and schedule recurring charges manually, difficult but works great once it’s set up.”

“This app teaches you how to actually budget, but it’s not plug-and-play.”

“Syncing issues can be frustrating if you’re outside the U.S.”

Many users claim YNAB as a great budgeting app alternative to Mint after the shutdown.

App Store

High ratings (4.8+ on App Store), but reviews reflect the complexity of the app.

Our Summary:

YNAB is the best option on this list if you’re already serious about budgeting and want to merge subscriptions into your broader financial plan.

It’s not build for simple subscription tracking and has steep learning curves and maintenance requirements.

But if you’re looking for a simple way to spot forgotten subscriptions, cancel them quickly, or get alerts, this isn’t the tool for that. It’s powerful, but not lightweight.

This one is for the budgeting nerds.

Orbit Money (Beta)

Website:

Best for:

People who feel overwhelmed by scattered subscriptions, forgotten free trials, or bloated budgeting tools, and want a simpler, smarter way to stay in control with deep features focused on the best subscription experience.

Orbit is being built for modern users who value clarity over complexity, especially freelancers, creators, and everyday professionals who manage a lot of tools and are busy and just want to cancel waste and clutter.

It’s more global-focused than some of the other platforms with some very intuitive features for handling subscriptions.

Type of Tracker:

Currently in development but planned subscription loading includes:

Bank and card integration for auto-detection (US and certain global markets)

Manual add, screenshot/spreadsheet upload and Email scanning

Platforms:

Planned for:

Web, iOS, Android. Mobile-first with synced web support.

Markets Served:

Waitlist open globally.

First markets focused on:

United States and Canada

Europe

Australia

Additional countries will follow as banking integrations expand and support is manageable.

Pricing:

Currently free while in waitlist/pre-release.

Live pricing TBD, but:

Will include a generous free tier and advanced and business features in premium tiers

Planned Key Features:

Automatic Subscription Tracking (via bank + email detection to fill in gaps)

Cancel / Reminder notifications – avoid forgotten trials or surprise renewals

Calm, distraction-free UI – no clutter, ads, or unnecessary tools

Smart Suggestions – for deal opportunities, changes, or missed savings. Using AI to improve the experience of personal finance.

Virtual cards and free-trial cards - More control over the payment source and specifically tackling free trials.

Pros: | Cons: |

|---|---|

Clean UX focused on recurring charge awareness for those with a high number of tools Global-focused, not just the US Privacy-focused and user-first (no selling your data) Resonates with freelancers, indie founders, creators, and ADHD-prone users who want less chaos in money management | Still in development: no public launch yet Not a full replacement for full budgeting apps (by design) Feature set still evolving with feedback |

What Users Are Saying (Waitlist):

Orbit is already attracting early attention from:

Mint & Rocket Money users looking for something simpler

Freelancers & founders frustrated by tools built only for “personal budgeting”

Common themes in early feedback:

“I just want easy and the ability to manage my free-trials and all my AI tools”

Our Summary:

Orbit Money is trying to be the powerhouse subscription platform on the market, blending AI features, deals and virtual cards to build a powerful subscriptions experience designed for those who are busy, have ADHD or manage large numbers of tools and free-trials.

It’s designed so that managing subscriptions isn’t a penny-pinching chore, but built naturally into everyday life. It was created because we were sick of tools that just don’t really solve the issue completely for the majority of the population.

Manage your money, without needing to manage your money.

While still in early development, the focused vision and user-first design philosophy make it one of the most promising new tools in this space.

Join the waitlist if you’re ready to track and manage smarter, without the noise:

Final Thoughts: Picking the Right Subscription Tracker for 2026

Whether you want full automation or manual control, the best subscription tracker app is the one that fits your financial habits, and helps you finally get on top of your subscriptions so they don’t get lost in the void

Some people prefer powerful automation tools like Rocket Money or Hiatus. Others want privacy-first manual options like Bobby, Subby, or TrackMySubs. And if budgeting is your core focus, YNAB or Emma might be a better fit.

But if you’re looking for one of the best ways to manage a larger number of tools and free trials with a more intuitive way to track and control your subscriptions; Orbit is an upcoming app worth keeping on your radar. It’s being built with features to help you stay on top of subscriptions while fitting into your lifestyle.

Still not sure? Start by listing your current subscriptions manually. You’ll quickly figure out what kind of tool you really need.

Frequently Asked Questions (FAQ)

What is the best subscription tracker app?

It depends on what you need. If you want a fully automated experience and live in the US, Rocket Money and Hiatus are strong picks.

For a cleaner, more focused experience that’s launching globally, Orbit is designed to reduce overwhelm and put you back in control of your subscriptions.

For manual tracking, Bobby (iOS) and Subby (Android) are great free options.

Which app can cancel subscriptions for me automatically?

Apps like Rocket Money, Hiatus, and Trim offer concierge-style cancellation, but the process can take days or weeks. Some also charge a success fee or require a premium plan. Orbit (in waitlist) is focused on streamlining the cancellation process: with faster, clearer flows and better visibility.

Is there a free app to cancel subscriptions?

Some apps offer limited free cancellation tools, but full concierge services usually require a paid plan. Rocket Money has a sliding scale for Premium, while Hiatus charges $9.99/month.

Can I track subscriptions without connecting my bank account?

Yes. Apps like Bobby, Subby, and TrackMySubs let you manually enter and track subscriptions without needing to sync a bank account: ideal for privacy-conscious users. Orbit is also building email-based detection, offering a privacy-first alternative to full bank syncing.

What’s the best subscription tracker app for Australia?

Most U.S.-based apps like Rocket Money, Hiatus, and Trim only support U.S. banks. For Australian users, tools like TrackMySubs (manual), Subby (Android), or Orbit (launching with AU support) are more suitable.

Read the full review on top subscription trackers in Australia.

Are free subscription trackers worth using?

Absolutely, especially if you’re comfortable with manual input. Free tools like Bobby, Subby, and the free tiers of Emma or Rocket Money can help surface forgotten charges. But for cancellation and automation, you’ll likely need a paid version or upgrade.

How do I know what subscriptions I’m paying for?

The easiest way is to use an app that connects to your bank account or credit cards and automatically scans for recurring charges. Apps like Rocket Money, Hiatus, and Orbit (in waitlist) offer this feature. You can also check statements manually or use email detection tools.

Is there a subscription tracker that works on both iOS and Android?

Yes. Rocket Money, Emma, and Hiatus have apps for both platforms. Orbit will launch on iOS, Android, and Web. Manual-only apps like Bobby (iOS) and Subby (Android) are platform-specific.

What’s the easiest app to use for tracking subscriptions?

If you prefer minimal effort, Rocket Money and Hiatus offer full automation. For simplicity without automation, Bobby and Subby have clean interfaces and one-time pricing. Orbit is focused on clarity, automation and user-first design for people who don’t want bloated dashboards.